Title:

A Snapshot of Investor Households in America

Summary:

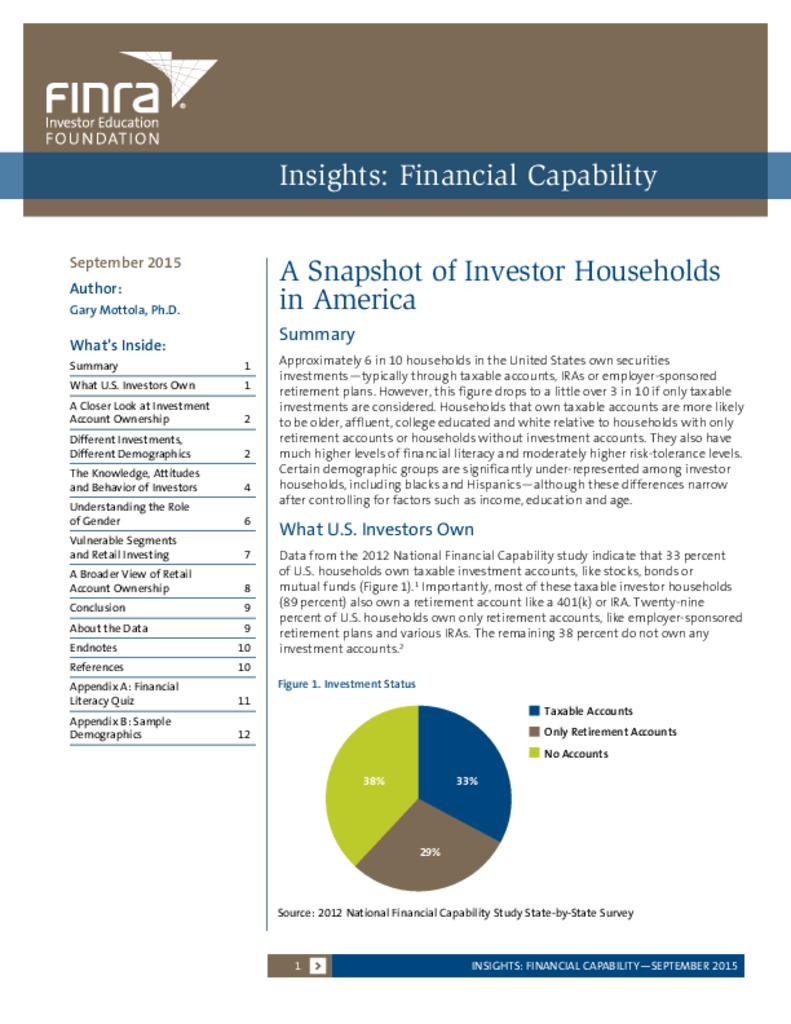

Using data from the 2012 NFCS, this research examined the demographic and financial characteristics of U.S. households with retirement and non-retirement investment accounts.

Type:

PDF

Size:

178.01 KB

Bookmark this page for access to the latest version of this file.